Running a business in today’s global economy can be both exciting and challenging. If you’re looking to expand into new markets, one of the first steps is ensuring that you have all the correct legal paperwork in place—especially when it comes to VAT. Whether you’re expanding into Spain, Europe, or even further afield, we’re here to make the process smooth and stress-free.

VAT can be hard to understand, especially if your business works in more than one country. We're here to make things easier for you by giving you expert advice on how to use the different VAT plans and exemptions. Whether you need to apply the One Stop Shop (OSS) to manage VAT across the EU or use the Reverse Charge Mechanism to transfer VAT liability to your buyer, we can guide you through each step. For businesses importing into Spain, we also assist with obtaining the Article 23 VAT exemption, allowing you to avoid paying VAT on imports, easing your cash flow.

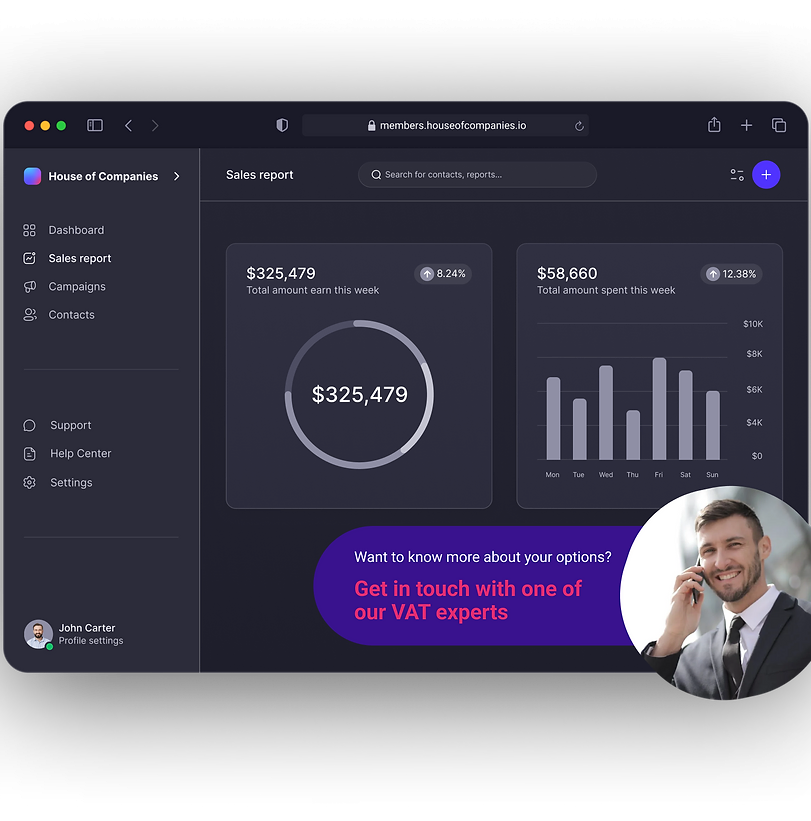

Our goal is to make VAT registration, compliance, and filing as smooth and hassle-free as possible for global entrepreneurs expanding into Spain. We handle the complexities, ensuring you stay compliant with all regulations so you can focus on growing your business with confidence. Let us handle your VAT requirements and offer the peace of mind that comes with expert support. Contact our team of professionals to start simplifying your VAT today!

If you have particular questions or concerns regarding your VAT circumstances, our team of VAT specialists is ready to assist you with a personalized Advisory Report. This comprehensive report will deliver valuable insights and tailored recommendations specific to your business needs, enabling you to make well-informed decisions. You can confidently Get around the intricacies of VAT with our help and optimize your plan for compliance.

Initial Consultation: Begin your journey with a thorough consultation to assess your business needs and determine the requirements for VAT registration. This step is crucial for understanding the specific regulations that apply to your operations in Spain.

Document Preparation: Gather all necessary documentation, including proof of business registration, identification, and any other relevant records. Our experts will guide you through this process, ensuring you have everything needed for a successful application.

Application Submission: Once your documentation is in order, submit your VAT application to the Spanish tax authorities. This step involves filling out the required forms accurately to avoid processing delays.

Application Review: After you submit your application, the tax authorities will review it. This process may involve verifying your documentation and, in some cases, requesting additional information.

VAT Number Issuance: Upon successful review, you will receive your unique VAT number. This number is essential for conducting business in Spain and enables you to charge VAT on your sales.

Compliance Guidance: With your VAT number activated, it's vital to understand your ongoing compliance obligations. This includes regular VAT returns and record-keeping requirements to ensure you remain compliant with Spanish VAT laws.

I had struggled with VAT compliance for years, but since using this platform, I feel in control. The expert advice and easy-to-use interface helped me secure my VAT number quickly. Now, I can focus on what I love—growing my business!

Anna PolinskiB2C Retail

Anna PolinskiB2C RetailWhat I appreciated most was the personal touch. The support team took the time to understand my unique situation and tailored their advice accordingly. This level of service is hard to find, and it made a significant difference!

Sofia Export Manager

Sofia Export ManagerThis portal has been an essential tool for my international expansion. The streamlined process for applying for a VAT number and the compliance management features have saved me countless hours. I'm incredibly satisfied with the service!

YukiBusiness Consultant

YukiBusiness Consultant

Learn More →

Learn More →

Learn More →

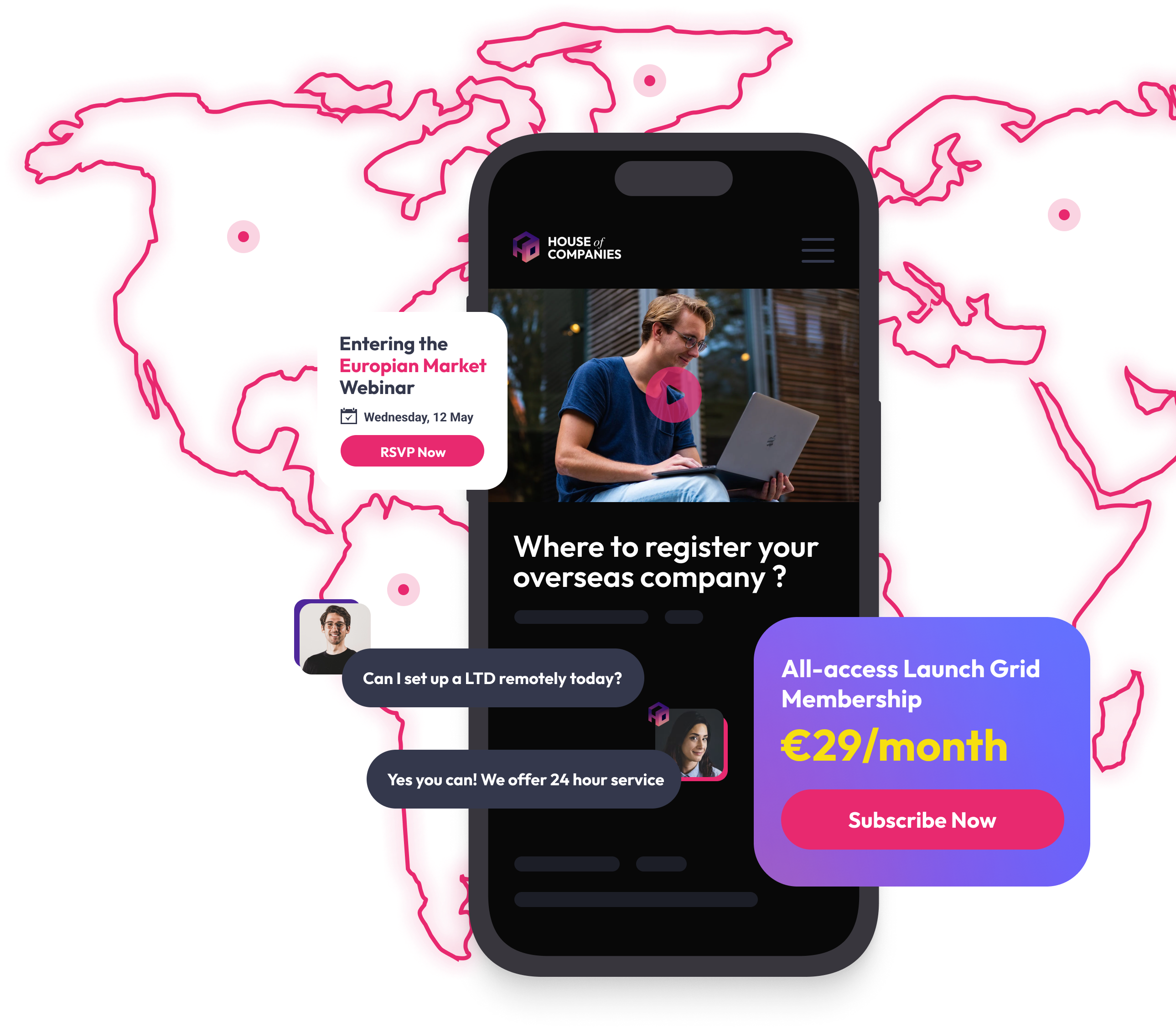

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!