Are you looking to find out the complexities of corporate tax in Spain? Achieving an optimized tax position while ensuring compliance with local regulations requires a strategic approach. Our Entity Management Services provide comprehensive corporate tax analysis tailored to meet the unique needs of your business.

Our team conducts thorough assessments of your corporate tax obligations. We analyze your entity structure, revenue streams, and operational activities to identify potential tax liabilities and opportunities for savings.

Are you a business owner feeling overwhelmed by bookkeeping? You’re not alone—many entrepreneurs struggle with invoices, receipts, and financial statements. But what if there’s a simpler way? We automate bookkeeping in Spain, allowing you to focus on what really matters: growth.

Automated bookkeeping isn’t just a trend; it’s a game-changer. By using advanced technology, we streamline your financial processes, ensuring accuracy and efficiency. Picture having real-time insights into your finances, easily tracking expenses, and staying compliant with local regulations. With our services, you can reclaim valuable hours and dedicate them to expanding your business.

Automated systems reduce human errors in data entry and calculations, leading to more accurate financial records.

Bookkeeping automation saves time on invoicing and reconciliations, which can be used for strategic duties.

Automated bookkeeping provides real-time insights into your financial health, enabling timely decision-making based on up-to-date information.

By reducing the need for manual labor and minimizing errors, automated bookkeeping can lower overall operational costs, making it a budget-friendly option for businesses.

Automated systems are often designed to adhere to local regulations, including tax laws in Spain, helping businesses stay compliant and reducing the risk of penalties.

The Entity Management Services team made our corporate tax analysis in Spain a breeze! Their expertise simplified a complex process, allowing us to focus on growth.

Maria G.

Maria G.Thanks to the corporate tax analysis, we identified significant savings opportunities that we never knew existed. The guidance we received gave us the confidence to move our operations to Spain.

James T.

James T.The team helped us every step of the way, from compliance to strategic planning. Their expertise in the Spanish market was invaluable, and we’re excited about our growth potential!

Emily R.

Emily R.If you’re looking to thrive in Spain’s bustling market, seeking full facilitation from an International Tax Officer is a smart move. Their expertise, personalized solutions, and proactive approach can transform the way you manage your tax obligations. By partnering with a tax officer, you’re not just investing in compliance; you’re investing in the future success of your business.

The standard corporate tax rate in Spain is 25% for most companies, though newly established companies may benefit from a lower rate of 15% for the first two years of profit.

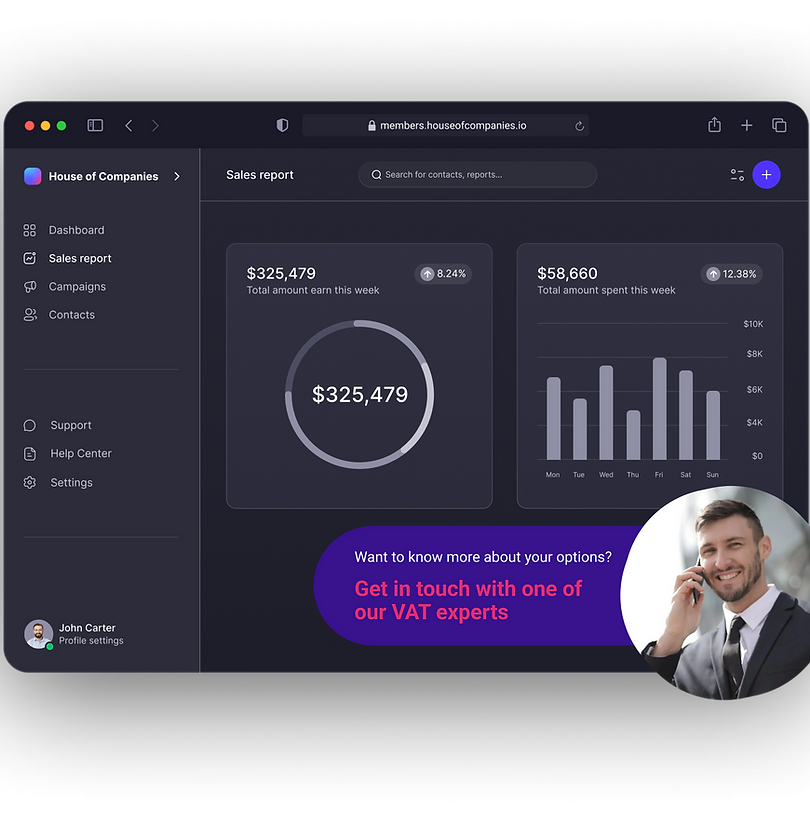

While not part of corporate tax, businesses in Spain also need to be aware of the VAT system, which is typically 21% for most goods and services.

The taxable base is determined by the company's accounting profit, adjusted for tax purposes. This includes adding or subtracting certain non-deductible expenses and tax allowances.

VAT Filing Case Studies

Learn how our Entity Management Services can make it easier for you to file your VAT in Spain. We show how our strategies for improving efficiency, lowering risks, and making sure people pay their taxes correctly have worked by using specific case studies. Find out how we help businesses deal with the complicated rules of VAT and make sure they file correctly and on time by looking at some real-life cases.

The Netherlands

Learn More →

United Kingdom

Learn More →

Estonia

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!