Are you considering the expansion of your e-commerce business into Spain? Discuss the intricacies of VAT and OSS filing can be daunting; however, it need not be a source of stress. Our Ecommerce OSS Filing services are designed to streamline the entire process, making it efficient and hassle-free for you.

Our Entity Management Service offers global expertise, including insights into non-EU markets. Recognizing that each business has its own distinct requirements, we customize our support to align with your specific objectives. Our knowledgeable team is dedicated to assisting you at every stage, allowing you to concentrate on what truly matters: the growth of your business.

Just think about how much easier it would be if your VAT and OSS returns were fully automated. That way, you could put all your energy into building your business! Simplify the entire process with our Entity Management Service in Spain for just 75 EUR each month. In order to make sure your online store runs well, we handle every detail.

Filing your VAT and OSS accurately and in accordance with Spanish legislation is a breeze with our automated system. You may rest assured that your taxes will be filed accurately, reducing the likelihood of any penalties or expensive mistakes.

However, our services extend beyond automation. We understand that every company has specific requirements. For that reason, you may rely on the individualized assistance of our committed staff. Our expert team is here to help you in any way they can, whether it's answering your questions or offering guidance.

"Automating our VAT filings with Entity Management services in Spain has been a game-changer. The process is so smooth and stress-free, and their team ensures everything is compliant. It saved us countless hours of manual work, allowing us to focus on growing our business. Highly recommended!"

Carlos M E-commerce Store Owner

Carlos M E-commerce Store Owner"The automated VAT filing service through Entity Management has made managing our taxes in Spain effortless. It’s reliable, easy to use, and their team is always available for support. We no longer worry about missing deadlines or dealing with complicated paperwork."

Sofia RDigital Marketing Agency Owner

Sofia RDigital Marketing Agency Owner"With Entity Management’s automated VAT services, filing in Spain has never been easier. The entire process is efficient, and we no longer have to stress over compliance issues. Their expertise and hands-on support made transitioning to automation simple and effective."

Miguel LInternational Trading Firm Manager

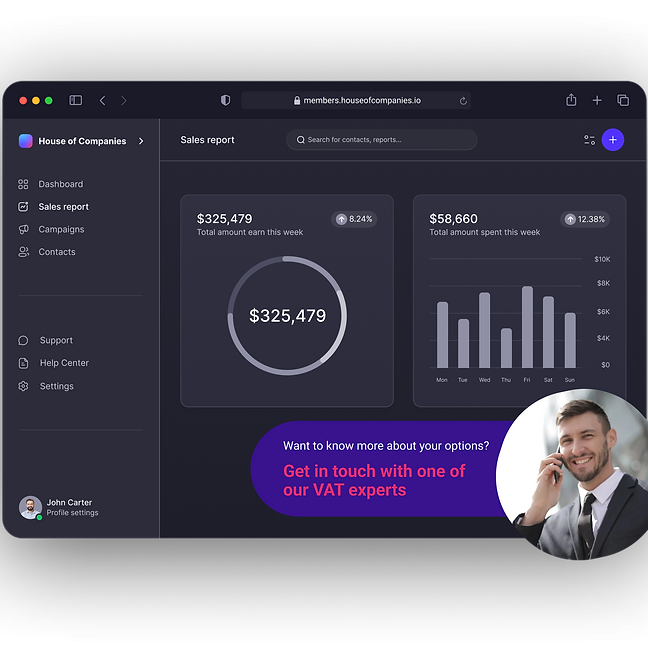

Miguel LInternational Trading Firm ManagerVAT compliance is complex, but you don't have to handle it alone! In order to provide you with individualized service, our Spain VAT Experts are available. Consider us to be your devoted traveling buddies. We are here to offer you specialized assistance that is catered to your particular requirements as a business. We are prepared to help, whether you need advice on how to manage your filings or are unclear about your VAT responsibilities. Our staff has extensive experience and understanding of the nuances of VAT in Spain. We'll spend time getting to know your company and then present you with options that make things easier.

Allow our VAT experts to help you have a smooth and effective automated VAT experience. You can concentrate on expanding your startup while we manage the intricacies of VAT compliance for you with individualized support catered to your particular business requirements!

Personalized Help: Our VAT experts take the time to learn about your business and give you advice that is unique to your case.

Compliance Assurance: Follow Spain's VAT rules to avoid fines that are very expensive. Our staff keeps you up to date on the most recent changes to tax rules.

Process Simplification: We help you set up effective methods that make filing your VAT easier, which speeds up and makes the process go more smoothly.

Access to Expertise: Our experienced team possesses extensive knowledge in VAT compliance and entity management, ensuring you receive top-tier guidance.

Comprehensive Solutions: We offer more than just VAT services; our entity management solutions encompass all facets of your business establishment in Spain.

Efficiency in Time and Costs: By collaborating with us, you alleviate administrative responsibilities, allowing you to concentrate on expanding your startup while maintaining compliance and operational efficiency.

Are you prepared to elevate your startup? Allow our VAT specialists to assist you in navigating your automated VAT processes with assurance. Reach out to us today to discover how we can facilitate your journey.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!