If you are a non-resident looking to navigate the landscape of accounting regulations in Spain, understanding the local requirements is essential for ensuring compliance and promoting financial transparency. Our Overview of Spanish Accounting Regulations for Non-Residents service is designed to simplify this process for you. We provide detailed guidance to help you understand the key regulations that govern accounting practices in Spain, allowing you to focus on your business operations without the burden of complex legalities.

In Spain, accounting practices are primarily regulated by the General Accounting Plan (Plan General de Contabilidad, or PGC), which outlines the principles and procedures for preparing financial statements. The PGC applies to all business types, including sole proprietorships, partnerships, and corporations. It sets forth a standardized chart of accounts and establishes uniform accounting principles to ensure comparability and accuracy in financial reporting. For companies classified as large or listed on the stock exchange, International Financial Reporting Standards (IFRS) may be applicable, promoting consistency in reporting across the European Union.

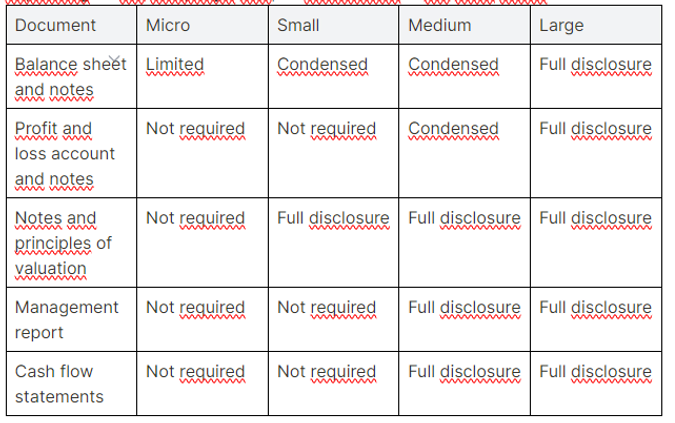

Understanding the financial thresholds is also crucial. For instance, companies in Spain are required to prepare annual financial statements, including a balance sheet, income statement, statement of changes in equity, and cash flow statement. Depending on the size and complexity of the business, an audit may be mandatory if it meets specific criteria—such as total assets exceeding €4 million, annual revenue exceeding €8 million, or employee counts above 50. These audits enhance the credibility of financial statements and ensure adherence to regulations, providing reassurance to stakeholders and potential investors.

Additionally, digitalization is becoming increasingly important in Spanish accounting practices. The government encourages the use of electronic invoicing and accounting software to streamline processes and reduce administrative burdens. Non-residents can benefit from our expertise in navigating these changes and leveraging technology to enhance their accounting practices. Our goal is to support you in establishing a compliant and efficient accounting framework in Spain, ensuring your business operates smoothly while meeting local regulations. With our comprehensive service, you can focus on growing your business, confident that your accounting practices are aligned with Spanish law.