Our simplified Entity Management services can help you manage your workers in Spain more easily. It is the most cost-effective and efficient approach to conduct recruitment or relocation in Spain, with no requirement for foreign tax lawyers or the establishment of a local organization. Let us handle your payroll and compliance issues.

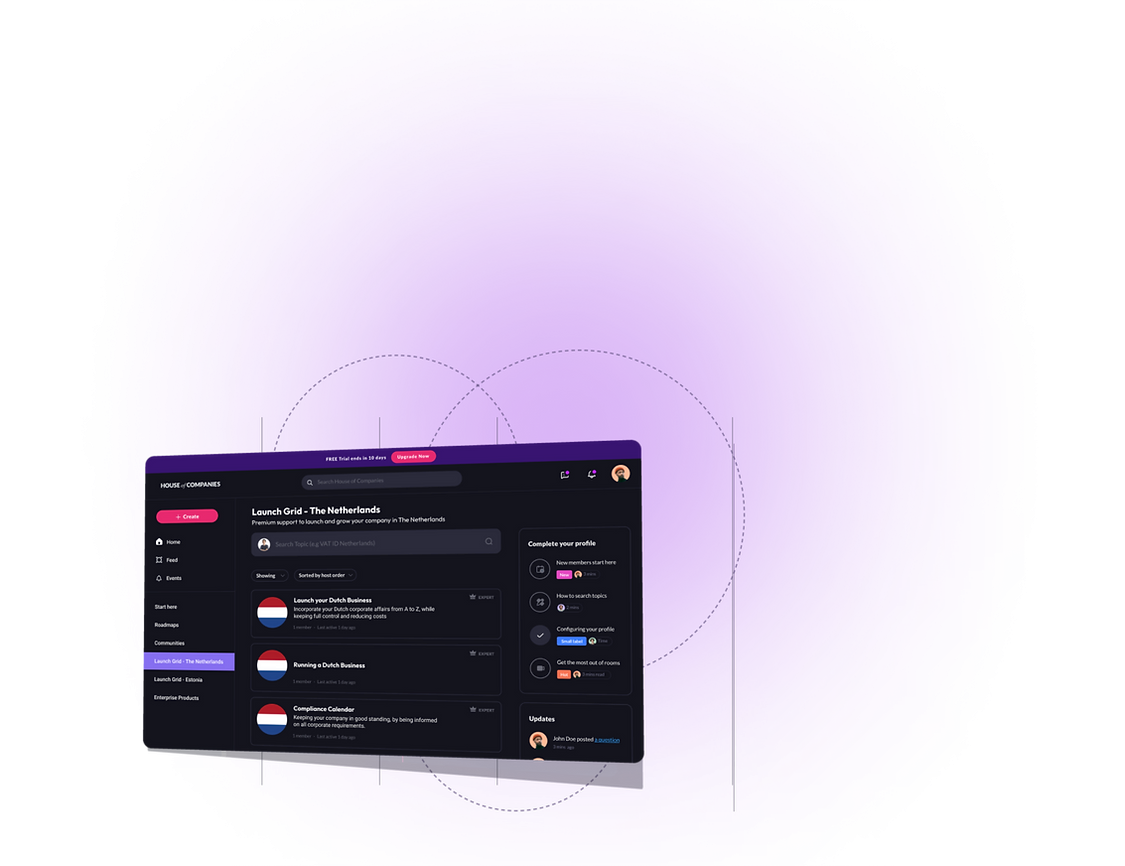

A complete market entrance solution designed especially for Spain is provided by our Entity Management Portal. We offer complete assistance to help your firm establish a successful presence in Spain, from company formation to regulatory compliance, guaranteeing a seamless and effective market entrance procedure.

"I highly recommend their payroll services! They’ve simplified our payroll process, ensuring timely payments and accurate tax calculations for our employees in Spain."

Ana Garcia

Ana Garcia"The payroll service in Spain has exceeded our expectations. Their friendly team is always available to answer our questions and provide support when needed."

Luis Sánchez

Luis Sánchez"Outsourcing our payroll to this service has been one of the best decisions we've made. They ensure everything is compliant with Spanish regulations and handle our staff's needs effectively."

Ana Garcia

Ana GarciaCertainly! If you're looking to develop your firm or break into the Spanish market, using a PEO (Professional Employer Organization) can be a good plan. The limitations of our Launch Grid are specific to your business and the unique payroll requirements in Spain.

There's no need to fear, though, as PEOs are essential to our community and their services, which are specifically designed for Spain, are detailed below.

Learn More →

Learn More →

Learn More →

Here are Five FAQs related to payroll staff in Spain:

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

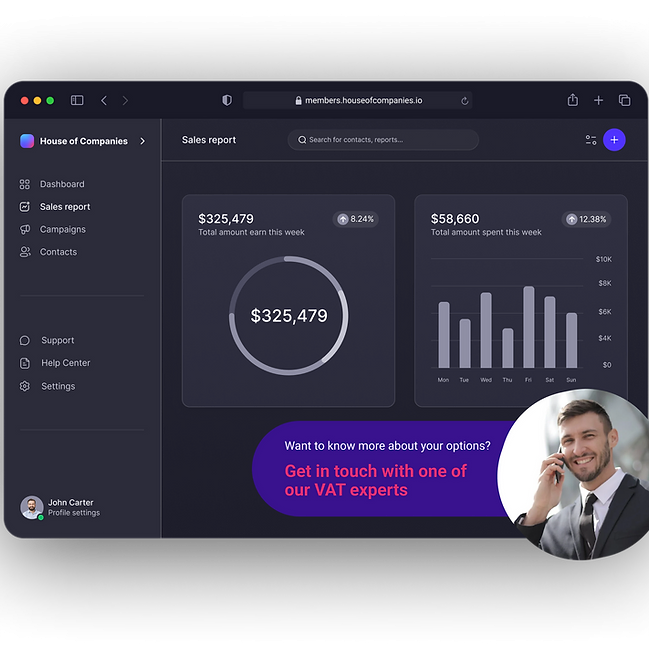

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!