Our Smart Company (SC) Registration service in Spain provides a professional and efficient solution for businesses aiming to establish a foothold in this vibrant European market, including those in the blockchain sector. Whether you’re expanding from a non-EU country or looking to diversify your operations within the EU, we offer extensive support to help you navigate the legal and regulatory landscape of SC registration. Let us assist you in successfully launching your business in Spain!

As part of our entity management services, we ensure that your blockchain business complies with Spanish corporate laws while taking full advantage of the country’s favorable business landscape. Our comprehensive service covers everything from document preparation to communication with local authorities, guaranteeing a smooth registration process. We recognize the unique demands of blockchain ventures and customize our approach to meet the specific regulatory and operational needs of this innovative sector.

Our experienced team is committed to providing personalized support for entity businesses, guiding you throughout the entire registration process. From the initial setup to ongoing compliance and growth strategies, we help you strategically position your blockchain company for success in Spain and beyond.

By managing administrative complexities from start to finish, we enable you to focus on harnessing blockchain technology and expanding your business into European and international markets. With our expertise, you can effectively navigate the complexities of blockchain regulations and set your company up for success in one of Europe’s most progressive business environments.

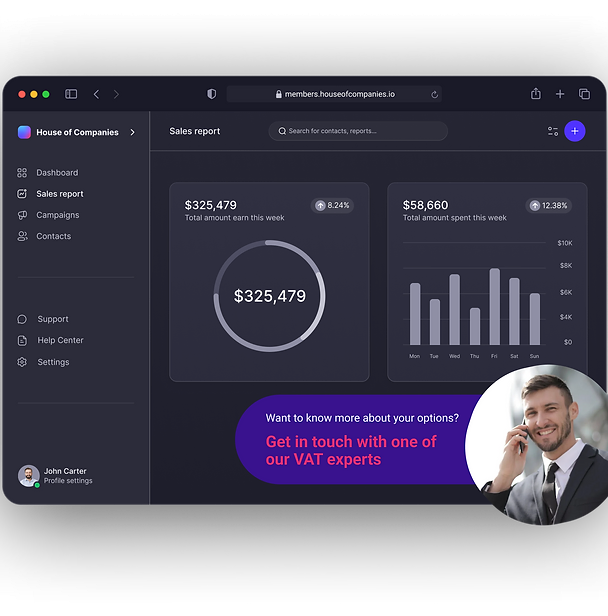

Registering a Smart Company (SC) in Spain has never been more efficient and flexible, thanks to our cutting-edge Self-Governance Portal. This innovative platform streamlines your business setup process, leveraging advanced blockchain technology to enhance transparency, security, and efficiency. Whether you want to expand into the EU or operate from a Spanish base in non-EU markets, our service provides a comprehensive solution for all your corporate registration needs.

Our Smart Company Registration service is a vital component of our comprehensive entity management solutions, tailored for businesses aiming to establish a robust foundation in Spain and expand their global footprint. Begin your registration process confidently through our innovative Self-Governance Portal, which leverages the security and efficiency of blockchain technology.

Access Our Self-Governance Portal

Enter our Self-Governance Portal to start the registration process for your Smart Company. Here, you will have complete control over the registration procedure. The portal aims to speed your interactions with Dutch authorities by providing a streamlined and intuitive interface for managing required paperwork and legal obligations.

Choose the SC Structure

Choose the Smart Company type that best meets your company's requirements. You can select from various structures depending on your business model, size, and industry. Our team of professionals is here to help you decide which structure would yield the most significant operational and tax benefits.

Submit Required Documents

The following documents are typically required to register a Smart Company in the Spain:

These papers can be safely uploaded through our site, and we check them to ensure they comply with Dutch laws.

Company Name Reservation

Through the web, you may confirm and reserve your company name to make sure it is distinct and complies with Dutch legal requirements. To prevent any disputes or hold-ups throughout the registration procedure, this step is essential.

Sign the Notarial Deed of Incorporation

Once your paperwork is in order, a notary will prepare and sign the Deed of Incorporation. This legal document formally establishes your Smart Company, and we help with it by working with qualified notaries to ensure everything is done quickly.

Register with the Dutch Chamber of Commerce (KvK)

Your Smart Company must be registered with the Dutch Chamber of Commerce (KvK). Our portal connects you directly with the KvK, ensuring seamless documentation submission. Upon registration, your company will receive a unique registration number confirming its legal status in the Spain.

Register for Dutch Tax Numbers

Your Smart Company needs to get a Value-Added Tax (VAT) number and a Dutch tax identification number (TIN) to function lawfully. Our staff facilitates this process through our portal, ensuring your business is easily registered with the Dutch tax authorities.

Open a Corporate Bank Account

Financial operations require a corporate bank account. We can help you open an account with a respectable Dutch bank so that business transactions can go smoothly domestically and abroad.

Finalize Registration and Begin Operations

After all procedures are finished, you will receive final confirmation of your Smart Company's registration, enabling you to begin operations in Spain formally. Our staff is available for any post-registration assistance to ensure your business operates effectively and conforms with all legal requirements.

Depending on your operating requirements and business objectives, registering a Smart Company (SC) in a strategic jurisdiction might have several benefits. Selecting the appropriate jurisdiction for your development ambitions is crucial because each one offers distinct advantages.

The Spain

Spain stands out as a premier choice for intelligent company registration thanks to its favorable business environment, strategic location within the European Union, and robust legal framework. By establishing your business in Spain, you can access a thriving market with advantageous tax treaties and a highly skilled workforce.

The United Kingdom

In spite of Brexit, the UK is still a severe candidate for SC registration. It provides a streamlined and quick registration process, advantageous company tax rates, and a reputable legal system. The UK remains a desirable alternative for companies looking to enter foreign markets due to its robust economy and worldwide trade linkages.

Singapore

It is a leading jurisdiction for registering Smart Companies and stands out as a worldwide financial center, especially for companies aiming to expand into Asia. Singapore offers a very advantageous business environment with its low corporate tax rates, tax incentives for new businesses, and robust intellectual property protections. Easy access to Asian markets is another benefit of its advantageous position.

The United Arab Emirates (UAE)

It is well known for its free zones, which provide unique advantages like corporation and income tax exemptions, 100% foreign ownership, and top-notch commercial infrastructure. The free zones in the United Arab Emirates are especially beneficial for companies looking to operate tax-free in a prime location with international access.

Hong Kong

Hong Kong is another vital jurisdiction; it is well-known for its free trade policies, low taxes, and few restrictions on foreign investment. With access to important markets like China, it is the perfect place for companies aiming to expand into the Asia-Pacific area. Hong Kong continues to be a popular location for SC registration due to its standing as a major global financial hub.

United States

Because of their robust legal frameworks, investor safeguards, and advantageous corporation tax structures, states like Delaware offer an ideal setting for registering Smart Companies. The United States is a crucial jurisdiction for businesses aiming to expand globally since it provides access to the largest economy in the world as well as a sizable local market.

Luxembourg

Provides fantastic chances for Smart Company registration in the EU. It offers robust banking and financial services, advantageous taxation, and adaptable company forms. Luxembourg is a desirable option for international companies due to its vast network of double taxation treaties.

Spain provides special benefits for starting a blockchain company because of its strong technology infrastructure and forward-thinking legal framework. Our in-depth manual will take you through the crucial processes of establishing your smart blockchain company, ensuring you do it quickly and by regional laws.

Understanding the Regulatory Framework

Spain is renowned for having a pro-blockchain regulatory environment. Start by learning about local rules and regulations pertaining to digital assets, blockchain, and cryptocurrencies. The Dutch government has established explicit rules to encourage blockchain development while guaranteeing adherence to anti-money laundering and financial regulations.

Choose the Right Business Structure

Your blockchain endeavor depends on your choice of business structure. Public limited businesses (NV), private limited companies (BV), and other options are available. The structure's benefits regarding liability, taxation, and operational flexibility vary. Our guide offers advice on selecting a structure that complements blockchain operations and your company's objectives.

Register Your Business

The Dutch Chamber of Commerce (KvK) is the place to register your blockchain company. The company name, articles of association, and proof of residence are among the required documents that must be submitted for the registration procedure. Our guide will go over the necessary paperwork and how to make sure the registration process goes well.

Obtain Necessary Licenses and Permits

Depending on your blockchain business operations, you might require particular licenses or permits. These can include permits to run a bitcoin exchange or offer blockchain-related financial services. Our guide describes the kinds of licenses you might require and the application process.

Set Up a Corporate Bank Account

Managing your company's finances in Spain requires opening a corporate bank account. Finding a financial institution that suits your needs is made easier by Spanish banks' familiarity with blockchain technology and cryptocurrency operations. Our guide provides information on the necessary paperwork and how to choose the best bank.

Comply with Tax Regulations

Blockchain companies operating in Spain are subject to local tax laws, which include VAT and corporate tax. Understanding your tax obligations is crucial for maintaining compliance and making the most of your tax plan. Our handbook covers tax rates, reporting requirements, and tax responsibility management.

Secure Intellectual Property

It's crucial to safeguard your blockchain innovations and technology with intellectual property rights. Spain has strong protection for intellectual property, including trademarks and patents. The steps involved in protecting your intellectual property and its advantages are described in our guide.

Develop a Compliance Strategy

Adhering continuously to Dutch and EU legislation is essential for your blockchain enterprise. Respecting know-your-customer (KYC) and anti-money laundering (AML) regulations is part of this. Our manual describes how to create a compliance plan and implement it to satisfy legal requirements.

Leverage Local Ecosystems and Networks

There are many industry events, conferences, and networking opportunities in Spain's booming blockchain community. Getting involved with local blockchain communities can help your business by bringing in collaborations, insights, and assistance. This handbook covers important networks and resources to assist you in integrating into the Dutch blockchain scene.

Get Professional Support

It might be difficult to navigate the intricacies of starting a blockchain company. Consulting with local professionals, such as accountants, lawyers, and blockchain specialists, can provide you the direction you need to guarantee a successful setup. Professional services that can help you along the way are recommended by our guide.

1. How does starting a blockchain firm in Spain benefit you?

Establishing a blockchain company in Spain has many advantages. With robust government support for innovation and digital transformation, Spain has a thriving IT sector. The nation provides access to finance through several European programs and tax incentives for tech businesses. It has a highly qualified, multilingual workforce and easy access to European markets thanks to its advantageous placement within the EU.

2. What is the first step in registering a blockchain business in the Spain?

The initial steps are selecting the right business structure and becoming acquainted with the local regulatory requirements. As soon as you have this information, you can register your company with the Dutch Chamber of Commerce (KvK).

3. What business structures do Spanish blockchain startups have?

Spanish blockchain startups typically choose between three main business structures: Sole Proprietorship (Autónomo) for individual entrepreneurs, Limited Liability Company (SL) for small to medium-sized ventures seeking limited personal liability, and Public Limited Company (SA) for larger businesses aiming to raise capital through shares, ensuring scalability and legal protection.

4. Do I need specific licenses or permits to operate a blockchain business in the Spain?

Operating a cryptocurrency exchange or delivering blockchain-related financial services may require special licenses or authorization. Our information covers licensing kinds and applications.

5. How do I register my blockchain business with the Dutch Chamber of Commerce (KvK)?

You must submit the firm name, articles of association, and evidence of address to the KvK. Our guide details the paperwork and actions needed for a flawless registration.

"The Self-Governance Portal made the Smart Company registration process easy. A safe and transparent setup was guaranteed by the incorporation of blockchain technology, and everything was simple thanks to the knowledgeable assistance. I heartily suggest it to anyone wishing to start a company in Spain.

Alex JFounder of Tech Innovators Inc.

Alex JFounder of Tech Innovators Inc."For us, using the Smart Company registration service changed everything. The procedure was expedited by the blockchain connectivity, which also offered security assurance. Our EU growth was hassle-free thanks to the team's outstanding support.

Maria LCEO of Global Ventures Ltd.

Maria LCEO of Global Ventures Ltd."The Self-Governance Portal's speed and effectiveness in helping us establish our company in Spain impressed us. We had transparency and dependability because to the blockchain technology, and the customer support was excellent. An excellent option for global companies.

David RDirector at InnovateTech Solutions

David RDirector at InnovateTech SolutionsRegistering a smart company may not be the best course of action for you. Our blogs and roadmaps go into greater detail on the advantages and disadvantages for every nation.

The House of Companies can help if you choose to incorporate a local business.

Please try our solutions and community to help your business expand internationally.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!