Excellent accounting services are provided by our new office in Spain to Spanish companies. Our particular areas of expertise for Spanish companies include tax filing and financial reporting.

Our local experience generates accurate, fast, Spanish-compliant financial reporting. We file taxes for you, removing local tax law concerns. We take care of compliance and financial reporting so you can focus on expanding your company.

Local and international businesses operating in Spain receive tailored client service. Our industry knowledge and human touch provide the best service available to every client. Trust experts in your financial management to free you to concentrate on your corporate objectives.

E-commerce and import traders can benefit from automated OSS filing.

With only one click, close your fiscal year and create financial statements!

All set to grow into Spain and beyond? Take care of and expand your company!

All set to expand to Spain and beyond? Oversee your business and your expansion!

It's getting easier and easier to provide and handle bank statements, bills, and agreements (like your lease). Because our services offer a single source for all papers, data, and reports, they make it easier to submit your data.

You can follow your earnings and development in real time in Spain with our system!

Spain's accounting regulations are primarily governed by the General Accounting Plan (Plan General de Contabilidad, PGC), which establishes the framework for financial reporting and accounting practices for companies operating in the country. The PGC outlines the principles and standards that must be followed, including the recognition, measurement, and presentation of financial statements. It aims to provide transparency, consistency, and comparability in financial reporting, facilitating informed decision-making by stakeholders.

In addition to the PGC, Spanish accounting regulations are influenced by international standards, particularly the International Financial Reporting Standards (IFRS) for listed companies. These companies are required to prepare their consolidated financial statements according to IFRS, while non-listed companies have the option to adopt either the PGC or IFRS. This dual approach allows for flexibility in reporting practices while aligning with global standards to enhance the comparability of financial information across borders.

Compliance with Spanish accounting regulations is essential for businesses, as it not only impacts financial reporting but also plays a critical role in tax obligations and legal requirements. Companies must maintain accurate and up-to-date accounting records, and they are subject to periodic audits depending on their size and legal structure. Failure to adhere to these regulations can result in penalties, legal issues, and reputational damage, underscoring the importance of robust accounting practices in Spain's dynamic business environment.

For corporate tax purposes, a company with substance in Spain, meaning it has a permanent establishment (PE), is subject to corporate income tax (CIT) on its worldwide income. In contrast, a non-resident company without a PE in Spain is only liable for CIT on income sourced from Spain, such as profits from a PE or income derived from Spanish real estate. This distinction is critical for companies considering their tax obligations when operating in the Spanish market.

The term "permanent establishment" is defined in Spanish tax law and aligns with the definitions outlined in applicable tax treaties. In situations where there are no treaties in place, the definition generally follows the guidelines established in Article 5 of the OECD Model Convention. This definition helps determine the threshold at which a foreign entity's activities in Spain create tax liability, influencing the strategic decisions of multinational companies.

Regarding value-added tax (VAT), a company with substance must register for VAT and charge it on sales of goods and services. A non-resident company without a PE in Spain may still be required to register for VAT if it makes taxable supplies in Spain, such as distance sales or e-services to Spanish consumers. To navigate these complexities, our entity management services provide comprehensive support, helping companies establish their legal presence, ensure compliance with local regulations, and optimize their tax obligations in Spain.

Non-resident entities looking to establish a presence in Spain have several legal entity options, each with distinct accounting and tax implications. The most common types include branch offices, subsidiaries, and foreign legal structures.

A branch office, also known as a permanent establishment (PE), is not a separate legal entity but an extension of the foreign company. It must be registered with the Spanish Commercial Registry and is subject to Spanish corporate income tax and value-added tax (VAT) on profits attributable to the branch. While the branch office is not required to file separate financial statements in Spain, the parent company's financial statements must be submitted to demonstrate compliance with local regulations.

Subsidiaries, by contrast, are independent legal entities incorporated under Spanish law. They must register with the Commercial Registry, file annual financial statements, and comply with all Spanish tax obligations, including corporate income tax, VAT, and payroll taxes. Subsidiaries offer greater administrative simplicity and autonomy compared to branch offices, making them a popular choice for foreign businesses.

Foreign companies may also choose to use their own country's legal structure when setting up a business in Spain. Spanish company law recognizes most foreign business structures, except sole proprietorships. However, utilizing a foreign legal structure can lead to increased complexity, particularly when managing obligations with multiple tax authorities in both Spain and the home country. To navigate these intricacies, our entity management services provide comprehensive support, helping businesses establish their legal presence, ensure compliance with local regulations, and optimize their tax obligations in Spain.

In Spain, there are a number of accounting requirements that must be met when registering a branch office. The foreign company's financial accounts must be submitted to the Spanish Companies Registry, and the branch must keep correct books and records. Establishing a Spanish payroll system, which includes withholding income tax and social security contributions, is necessary if the branch has employees.

The branch office is required to file frequent VAT filings, usually every quarter, and its profits are subject to Spanish corporate income tax. Transactions between the branch and its overseas head office are also subject to transfer pricing requirements, which call for appropriate evidence to back up the division of profits between the two organizations. These rules are essential for adherence and have a big influence on the branch's total tax obligation.

Several variables, such as the extent of operations in Spain, tax implications, and administrative effectiveness, influence the choice to open a branch office, subsidiary, or employ a foreign legal structure. It is suggested that non-resident entities seek advice from tax and legal experts to ascertain the most appropriate structure for their particular requirements. Our entity management services can offer all-encompassing assistance, guiding companies through the intricacies of Spanish laws, guaranteeing adherence, and maximizing their operational plan in the Spanish market.

Non-resident entities operating in Spain must comply with various tax registration requirements to ensure adherence to Spanish regulations. These obligations include registering for value-added tax (VAT), payroll taxes, and corporate income tax, depending on the nature and extent of their business activities in the country.

For instance, if a non-resident entity sells goods or services in Spain, it must register for VAT and charge VAT on applicable sales. Additionally, if the entity has employees working in Spain, it is required to register for payroll taxes to ensure compliance with local labor laws. Corporate income tax obligations will also arise if the entity has a permanent establishment in Spain, necessitating registration for CIT.

Understand these registration requirements can be complex, which is why our entity management services are designed to assist non-resident businesses. We provide expert guidance through the registration process, ensuring that all necessary tax registrations are completed accurately and efficiently, thus minimizing the risk of non-compliance and associated penalties.

VAT compliance in Spain is essential for businesses operating within the country, as it governs the collection and remittance of value-added tax on goods and services. Businesses must register for VAT if they exceed the established threshold for taxable sales or if they engage in certain activities, such as selling goods to Spanish consumers or providing services within Spain. Once registered, businesses are required to issue VAT invoices, maintain accurate records of transactions, and submit periodic VAT returns to the Spanish tax authorities (Agencia Tributaria). The standard VAT rate in Spain is currently set at 21%, with reduced rates applicable to certain goods and services.

To ensure ongoing compliance, businesses must also be aware of specific invoicing and reporting requirements. This includes adhering to regulations on the format and content of invoices, ensuring they are issued in a timely manner, and filing VAT returns accurately and on time. Failure to comply with VAT regulations can lead to significant penalties and interest charges. To navigate the complexities of VAT compliance, many companies turn to expert entity management services, which provide support in understanding local regulations, preparing and submitting VAT returns, and maintaining proper documentation, thereby minimizing the risk of non-compliance and allowing businesses to focus on their core operations.

One of the most important things to do when running a business in Spain is to register as an employer if you intend to hire and pay employees. This stage guarantees complete adherence to Spanish labor laws, including those about social security, taxes, and other employment-related rules.

Our entity management services in Spain are intended to make it easier for companies to register as employers. We help with everything from getting the required registration numbers to making sure payroll requirements are met. You can concentrate on expanding your company while our knowledgeable staff takes care of these important duties, knowing that all of your legal and regulatory responsibilities will be met.

Corporate income tax (CIT) is levied on the worldwide income of Spanish-resident businesses, which covers all profits made both domestically and abroad. In Spain, the regular corporate tax rate is 25%; however, during the first two years of profitability, newly established companies may be eligible for a lower rate of 15%. Businesses must subtract permitted expenses, like depreciation and operational costs, from their total income in order to determine their taxable base. In order to support their tax filings and adhere to Spanish tax laws, firms must keep correct financial records.

Companies that are residents of Spain are subject to a number of reporting requirements in addition to the usual CIT responsibilities. Every year, businesses must submit corporation tax returns (Form 200), which include information about their earnings, outlays, and tax obligations. Usually, July 25 of the year after the end of the tax period is the date for filing these returns. In order to maintain a consistent flow of income for the Spanish government, businesses may also be obliged to make periodic tax payments throughout the year, based on their expected tax responsibilities.

Additionally, Spanish-resident businesses have to deal with extra tax requirements including value-added tax (VAT), which is typically 21% on sales and services. In order to report collected and deducted VAT, they must file quarterly and annual VAT reports and register for VAT if their taxable operations surpass specific levels. Resident companies can optimize their tax positions, minimize potential penalties, and assure compliance with Spanish regulations by comprehending and managing these corporate tax obligations. This procedure can be made easier by using professional entity management services, which guarantee that every facet of tax compliance is managed effectively.

To adhere to local laws and regulations, resident enterprises in Spain must maintain correct bookkeeping and financial reporting. The Spanish Commercial Code and the Spanish Generally Accepted Accounting Principles (Spanish GAAP) are the main laws that govern these duties under Spanish law. To make sure that their accounting procedures accurately depict the company's financial situation, businesses must maintain thorough records of all financial activities. Because it forms the foundation for corporate income tax assessments, this careful record-keeping is essential for tax purposes.

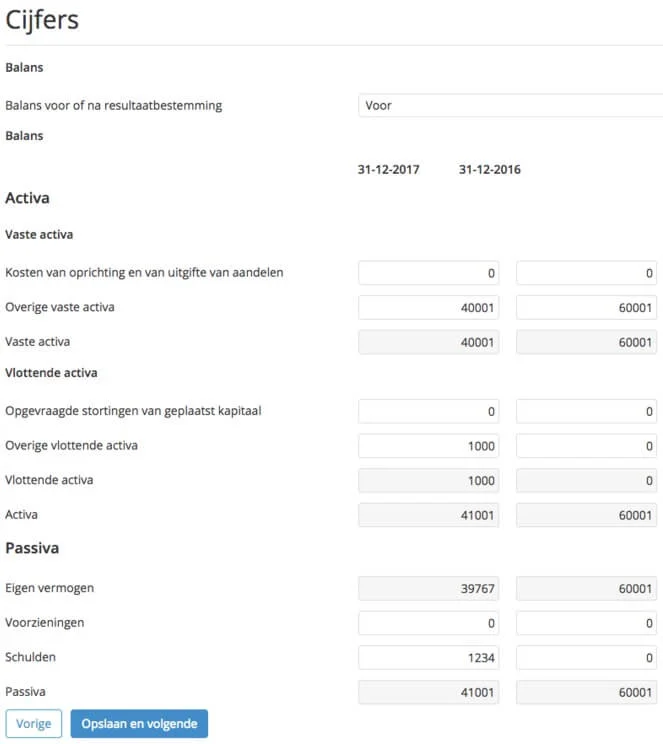

Requirements for Financial Statements

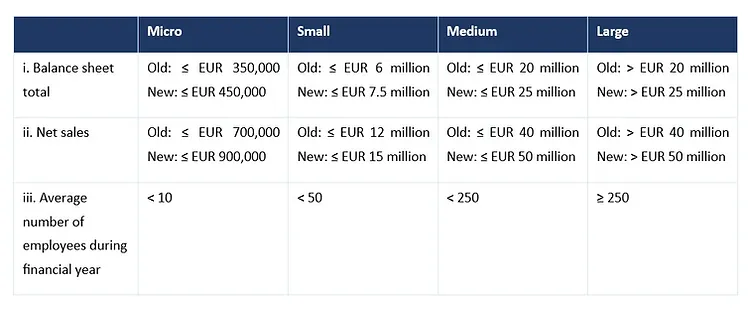

Annual financial statements, which normally consist of a balance sheet, profit and loss account, and notes to the accounts, are required of Spanish business entities. The company's financial performance and position should be accurately presented in the financial statements, which must be prepared in compliance with Spanish GAAP. These declarations, which must be submitted to the Spanish Commercial Registry, are crucial parts of corporate governance and require preparation and approval. Different publication requirements may apply depending on the size of the company; larger companies may be required to disclose information more thoroughly.

Financial Statement Content

Along with a profit and loss statement that lists the company's revenues, expenses, and profits or losses for the period, the financial statements must also have a clear and complete balance sheet that lists the company's assets, liabilities, and equity. Furthermore, pertinent details regarding the accounting principles used and any noteworthy modifications made during the reporting period should be included in the notes to the accounts. Spanish legislation places a strong emphasis on accuracy and transparency, guaranteeing that companies function within a strictly regulated financial environment. Maintaining the company's reputation and fulfilling tax obligations depend on adherence to these bookkeeping and financial reporting regulations, which will ultimately help it succeed in the Spanish market as a whole.

In Spain, the consolidation of financial statements is governed by the Spanish General Accounting Plan (Plan General de Contabilidad, PGC) and the International Financial Reporting Standards (IFRS) for companies listed on regulated markets. These standards dictate that a parent company must consolidate its financial statements with those of its subsidiaries to present a comprehensive view of the financial position and performance of the entire group. This process includes combining the financial data of all entities within the group, eliminating inter-company transactions, and reflecting any non-controlling interests.

Requirements for Consolidated Financial Statements

The preparation of consolidated financial statements is mandatory for companies that meet specific criteria, such as having a controlling interest in one or more subsidiaries. The consolidated financial statements must include a consolidated balance sheet, consolidated income statement, consolidated statement of changes in equity, and consolidated cash flow statement. These documents must comply with the applicable accounting standards, providing stakeholders with a transparent and accurate overview of the group's financial health.

Role of Entity Management Services

Entity management services play a crucial role in helping companies navigate the complexities of consolidation standards in Spain. These services ensure that all legal and regulatory requirements are met, from entity formation to ongoing compliance with accounting standards. By leveraging expert guidance, businesses can efficiently manage their consolidation processes, ensuring accurate and timely reporting while minimizing the risk of errors or non-compliance. Our entity management services are designed to support businesses through every stage of the consolidation process, enabling them to focus on strategic growth and operational excellence.

In Spain, it is legally required that only large and medium-sized businesses, as well as those that prepare their financial statements using International Financial Reporting Standards (IFRS), have their annual accounts audited by a qualified, independent, and registered auditor. The auditor's report must confirm that the financial statements appropriately depict the company's financial status and performance for the fiscal year and adhere to the relevant accounting rules. Companies may also elect to voluntarily have their financial statements audited in order to increase stakeholder confidence and credibility.

In Spain, companies are required to publish their financial statements to ensure transparency and compliance with legal obligations. The publication requirements vary depending on the size and type of the company. Generally, all companies must file their annual accounts with the Registro Mercantil (Commercial Registry), which makes them accessible to the public.

For large and medium-sized companies, the financial statements must include a balance sheet, income statement, cash flow statement, and notes to the accounts. These documents must be submitted within three months following the end of the fiscal year. Additionally, companies that prepare their accounts in accordance with International Financial Reporting Standards (IFRS) must include a management report.

Non-compliance with these publication requirements can lead to penalties, including fines and restrictions on business operations. Therefore, businesses operating in Spain should ensure timely and accurate submission of their financial statements to uphold legal and regulatory standards.

In Spain, all companies are required to file their annual accounts with the Registro Mercantil (Commercial Registry) to comply with legal obligations and maintain transparency. The annual accounts must typically include the following components:

Balance Sheet: A financial statement that presents the company's assets, liabilities, and equity at a specific point in time, reflecting its financial position.

Income Statement: This document summarizes the company’s revenues, expenses, and profits or losses over a financial period, providing insights into its operational performance.

Cash Flow Statement: This statement outlines the inflows and outflows of cash and cash equivalents during the reporting period, highlighting the company's liquidity and financial health.

Notes to the Accounts: These notes provide additional detail and context regarding the financial statements, including accounting policies, contingent liabilities, and any significant events that may impact the financial position.

The annual accounts must be filed within three months following the end of the fiscal year. For most companies, the fiscal year aligns with the calendar year, ending on December 31, meaning the filing deadline is typically March 31 of the following year. It is essential for companies to ensure accuracy in their financial statements and timely submission to avoid potential fines and penalties associated with late or incorrect filings. Non-compliance can also result in restrictions on business operations, underscoring the importance of adhering to these requirements.

Businesses in Spain who want to simplify their financial operations now depend on online bookkeeping services. These services provide an extensive feature set designed to satisfy the unique requirements of both new businesses and established corporations. Online accounting services use technology and professional knowledge to manage financial data effectively and give accurate financial reports, assisting businesses in staying compliant and making wise decisions.

In today’s fast-paced business environment, online bookkeeping services in Spain provide companies with the flexibility and efficiency needed to manage their financial operations effectively. These services cater to businesses of all sizes, offering tailored solutions that meet specific accounting needs. With a focus on accuracy and compliance, professional online bookkeepers utilize advanced technology to deliver timely financial reports and maintain meticulous records.

By choosing online bookkeeping, businesses in Spain can benefit from reduced administrative burdens, allowing them to concentrate on growth and strategic initiatives. The convenience of accessing financial information anytime and anywhere empowers decision-makers to stay informed and proactive in their financial management. Moreover, these services help ensure adherence to Spanish tax laws and accounting regulations, mitigating the risks of non-compliance.

With a dedicated team of experts at your fingertips, online bookkeeping services provide invaluable support for understanding Spain’s financial landscape. Whether you’re a startup or an established enterprise, leveraging these services can enhance operational efficiency and drive business success in a competitive market.

When considering online bookkeeping services in Spain, understanding the pricing structure is essential for making informed financial decisions. Generally, pricing can vary based on several factors, including the complexity of your business’s financial needs, the volume of transactions, and the specific services required. Here’s a breakdown of common pricing models:

Monthly Subscription Fees: Many online bookkeeping services offer a tiered monthly subscription model. Basic packages may start from around €50 to €150 per month, catering to small businesses with straightforward accounting needs. More comprehensive packages, which include additional services such as tax filing and financial consulting, can range from €150 to €500 or more per month.

Hourly Rates: For businesses that require more flexible bookkeeping support, some providers charge hourly rates. These rates typically range from €30 to €100 per hour, depending on the bookkeeper's expertise and the complexity of the services being rendered. This model can be advantageous for startups or companies with fluctuating bookkeeping needs.

Per Transaction Fees: Certain services may charge based on the volume of transactions processed. This approach is often beneficial for businesses with varying transaction volumes, as it allows you to pay for only what you use. Transaction fees can range from €0.10 to €2.00 per transaction, depending on the service provider.

Customized Packages: Many online bookkeeping firms in Spain offer customized packages tailored to specific business requirements. These packages can include various services, such as payroll processing, tax preparation, and financial reporting. Pricing for these tailored solutions can vary widely, depending on the services included and the level of complexity.

When evaluating online bookkeeping services in Spain, it’s essential to consider not only the cost but also the value provided. Investing in professional bookkeeping can save time, reduce stress, and help ensure compliance with local regulations. Always seek detailed quotes and clarify the scope of services offered to find the best fit for your business needs.

Online bookkeeping services in Spain offer a range of features designed to streamline financial management for businesses of all sizes. Here are some of the key features that make these services essential for effective bookkeeping:

Real-Time Financial Monitoring: Online bookkeeping platforms provide real-time access to financial data, enabling business owners to monitor their finances at any time. This transparency helps in making informed decisions and staying on top of cash flow.

Automated Data Entry: Many online bookkeeping services utilize advanced technology to automate data entry processes. This reduces the risk of human error, saves time, and ensures that financial records are accurate and up to date.

Comprehensive Reporting: These services typically include customizable financial reporting features, allowing businesses to generate reports such as profit and loss statements, balance sheets, and cash flow statements with ease. This facilitates better financial analysis and planning.

Secure Cloud Storage: Online bookkeeping services offer secure cloud storage for all financial documents and records. This ensures that important information is accessible from anywhere while providing robust data protection and backup.

Integration with Other Software: Many online bookkeeping platforms can integrate seamlessly with other business tools, such as invoicing software, payment processors, and tax compliance applications. This interconnectedness helps streamline financial operations and improve efficiency.

Expert Support and Consultation: Most online bookkeeping services provide access to certified accountants and financial experts. This support can be invaluable for businesses needing guidance on complex financial matters, tax planning, and compliance with local regulations.

Payroll Processing: Many services include payroll management features, allowing businesses to efficiently handle employee salaries, deductions, and tax withholdings. This ensures compliance with labor laws and simplifies the payroll process.

Expense Tracking and Management: Online bookkeeping platforms often come with tools for tracking and categorizing business expenses, making it easier to manage budgets and identify cost-saving opportunities.

Mobile Accessibility: Many online bookkeeping services offer mobile apps, enabling business owners to access their financial data, upload receipts, and manage bookkeeping tasks on the go, ensuring flexibility and convenience.

Tax Compliance: These services typically include features that help businesses stay compliant with Spanish tax regulations. They provide tools for tax calculation, filing, and documentation, reducing the risk of penalties and ensuring timely submissions.

Spanish bookkeepers who specialize in a certain industry offer a depth of expertise that extends beyond basic accounting concepts. Their comprehensive knowledge of industry-specific laws, tax ramifications, and sound financial procedures allows them to:

Protect Organizations' Financial Policies: These experts make sure that an organization's financial procedures comply with industry norms and legal regulations, preserving the company's financial stability.

Verify Adherence to Spanish Industry-Specific Guidelines: Industry-specific bookkeepers assist companies in navigating the difficulties of compliance by assuring adherence to all pertinent laws and standards through their knowledge of local legislation.

Rapidly Find and Fix Errors: Their specific expertise makes it possible to find and fix inconsistencies in financial records quickly, reducing the possibility of expensive errors and guaranteeing accurate reporting.

Keep a Close Eye on the Business Environment: These bookkeepers keep up with industry-specific advancements, market trends, and economic shifts, which allows them to offer insightful opinions that can affect financial strategy and decision-making.

They are extremely competent at handling intricate relationships within the Spanish business ecosystem because of their experience, which enables them to collaborate with a wide range of stakeholders, including clients and senior management.

Industry-specific bookkeepers in Spain offer tailored financial solutions designed to meet the unique needs of various sectors. Their deep understanding of the local market and specialized regulations allows them to deliver services that go beyond standard accounting practices. Here’s how they add value to businesses in Spain:

Expertise in Local Regulations: Industry-specific bookkeepers possess a comprehensive knowledge of Spanish accounting laws and industry guidelines. This ensures that businesses remain compliant with local regulations, reducing the risk of penalties and legal issues.

Customized Financial Reporting: They provide financial reports that reflect the unique aspects of each industry, allowing businesses to make informed decisions based on accurate and relevant data. This tailored approach helps organizations better understand their financial health and performance.

Proactive Tax Planning: With a keen awareness of sector-specific tax implications, these bookkeepers can help businesses optimize their tax strategies. They identify potential deductions and credits that may be available, ensuring that clients minimize their tax liabilities while adhering to Spanish tax laws.

Error Detection and Resolution: Their expertise enables them to quickly identify discrepancies or irregularities in financial statements. By addressing these issues promptly, they help businesses maintain accurate records and avoid costly mistakes.

Insightful Industry Knowledge: Industry-specific bookkeepers stay up-to-date with market trends and sector developments. This knowledge allows them to provide strategic insights and recommendations that align financial practices with industry best practices.

Virtual bookkeeping assistants have become an essential asset for businesses in Spain looking to streamline their financial management processes. These skilled professionals offer remote support, efficiently managing financial records, transactions, and reporting. By utilizing advanced accounting software and tools, virtual bookkeeping assistants in Spain handle various tasks, including data entry, reconciliations, payroll processing, and expense tracking with precision.

Their expertise helps businesses maintain accurate financial records while saving time and resources, making them a valuable solution for both small enterprises and larger companies in the Spanish market. With the flexibility to adapt to the unique needs of different industries, virtual bookkeeping assistants provide the support necessary for organizations to focus on their core operations while ensuring compliance and financial accuracy.

Virtual bookkeeping assistants in Spain bring a wealth of expertise tailored to the unique needs of Spanish businesses. These professionals are well-versed in local accounting regulations, tax compliance, and industry-specific financial practices. By leveraging their knowledge of the Spanish financial landscape, they ensure that businesses maintain accurate records while adhering to all legal obligations. Their familiarity with the nuances of Spanish tax laws enables them to provide proactive guidance, helping businesses optimize their tax positions and avoid costly pitfalls.

Moreover, virtual bookkeeping assistants utilize advanced accounting software to streamline financial processes, allowing for real-time data access and reporting. This technological proficiency not only enhances efficiency but also improves the accuracy of financial management. Whether it’s managing payroll, tracking expenses, or reconciling accounts, these assistants play a crucial role in supporting businesses to operate smoothly. Their ability to work remotely means that they can adapt to the dynamic needs of businesses, providing flexible solutions that drive growth and financial stability in an increasingly competitive market.

Pricing Overview

Virtual bookkeeping services in Spain offer a range of pricing models designed to accommodate the diverse needs of businesses, from startups to established enterprises. Typically, service providers may offer monthly subscription plans, hourly rates, or customized packages based on specific service requirements. Basic packages often start around €200 to €500 per month for small businesses, which usually include essential services like data entry, monthly reconciliations, and basic financial reporting. For more comprehensive solutions—such as payroll management, tax preparation, and in-depth financial analysis—pricing can range from €500 to €1,500 per month, depending on the complexity and volume of transactions.

Key Features

Virtual bookkeeping services in Spain come equipped with several key features that enhance efficiency and ensure compliance. These features often include:

Real-Time Financial Reporting: Businesses receive timely updates on their financial status, enabling better decision-making.

Cloud-Based Accounting: Utilizing cloud technology, virtual bookkeeping allows for secure access to financial data anytime, anywhere, ensuring seamless collaboration.

Automated Processes: Routine tasks such as invoicing, expense tracking, and bank reconciliations are automated, reducing the risk of errors and freeing up time for strategic activities.

Expert Consultation: Many providers offer access to financial experts who can advise on tax compliance, cash flow management, and financial planning tailored to the Spanish market.

Scalability: As your business grows, virtual bookkeeping services can easily scale to meet your changing needs, whether it’s handling increased transaction volumes or expanding service offerings.

By choosing virtual bookkeeping services in Spain, businesses can enjoy streamlined financial management while benefiting from specialized expertise and flexibility tailored to their unique operational requirements.

The cost of hiring a virtual bookkeeping assistant in Spain can vary widely based on several factors. Pricing models typically include hourly rates, fixed monthly retainers, or project-based fees. Hourly rates for virtual bookkeeping assistants in Spain can range from €15 to over €70, influenced by the assistant's experience, expertise, and the complexity of the tasks involved.

For businesses seeking more consistent support, many virtual bookkeeping services in Spain offer monthly subscription plans. These plans are generally tiered, allowing companies to choose the level of service that best fits their needs and budget. Some providers offer flat rates for a specified number of hours each week or month, resulting in a predictable cost structure for financial management.

Additionally, pricing may vary depending on the virtual assistant's location. Assistants based in countries with a lower cost of living, such as Latin American nations, may offer lower rates compared to those based in Spain or other Western European countries, while still delivering high-quality services.

Virtual bookkeeping assistants provide a wide array of services to support businesses in Spain, including:

Transaction Recording and Reconciliation: Accurate tracking of financial transactions to ensure proper record-keeping.

Accounts Payable and Receivable Management: Efficient management of incoming and outgoing payments to maintain cash flow.

Bank Statement Reconciliation: Regular checks to align bank statements with internal records.

Preparation of Financial Statements: Compilation of balance sheets, income statements, and cash flow statements for insightful reporting.

Payroll Processing: Handling employee payments, tax withholdings, and compliance with local labor laws.

Tax Compliance and Preparation: Ensuring that all tax obligations are met by Spanish regulations.

Integration with Popular Accounting Software: Seamless linking of financial records with widely-used software for enhanced efficiency.

Real-Time Financial Reporting and Analytics: Up-to-date insights into financial performance for better decision-making.

Custom Report Generation: Tailored financial reports based on specific business needs.

Multi-Currency Support for International Businesses: Managing transactions in various currencies for companies operating across borders.

These services empower Spanish businesses to maintain accurate financial records, ensure compliance with local tax laws, and gain valuable insights for strategic planning and growth.

Learn More →

Learn More →

Learn More →

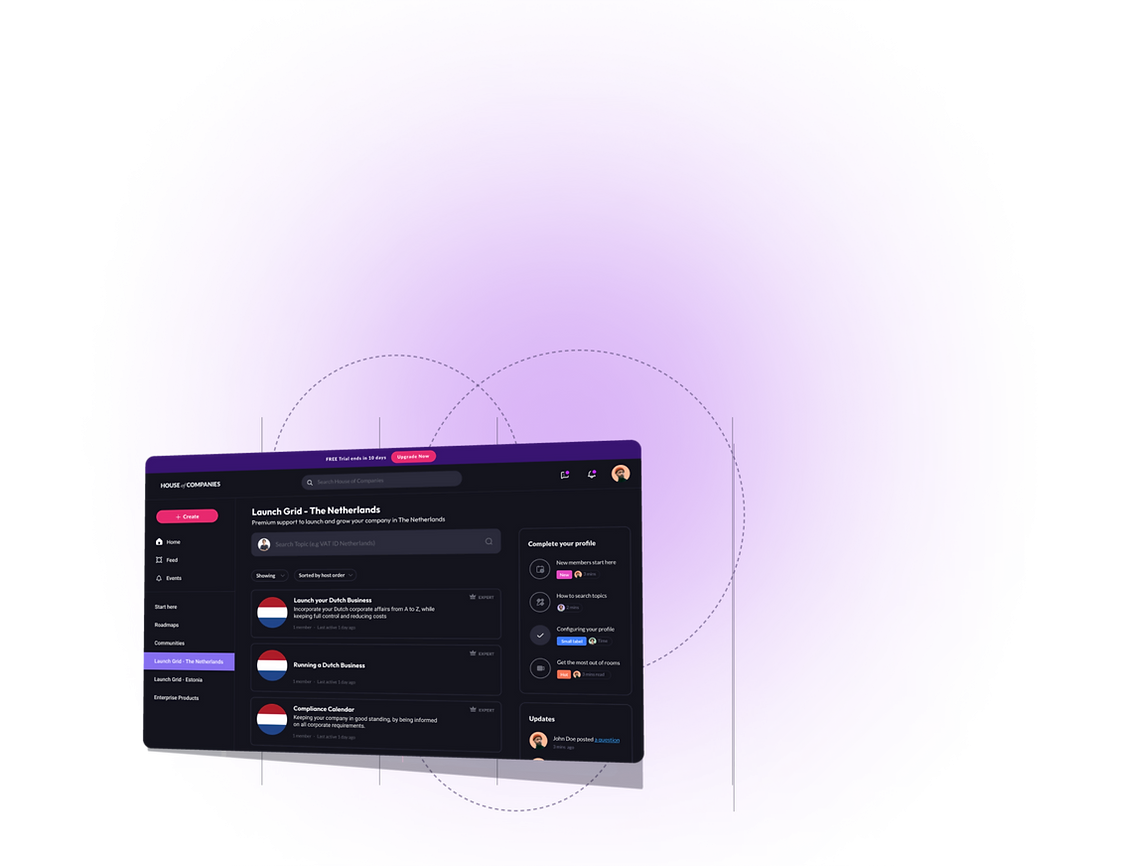

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!