You can easily file VAT in Spain! Get ready to simplify your VAT returns and ensure compliance effortlessly with the right guidance and tools! Whether you're a savvy entrepreneur or stepping into the Spanish market for the first time, an efficient VAT filing system can streamline your process, minimize mistakes, and keep penalties at bay. Prepare to streamline your VAT filing in Spain! Let’s get started today!

Diving into new markets for your business can spark a thrilling adventure, yet it may also feel a bit overwhelming. In Spain, grasping the complexities of local regulations, particularly concerning taxes, is essential for a successful market entry. Our all-in-one entity management services are here to simplify your operations, making it easy to submit your VAT return in Spain.

Working with their Entity Management team was a game-changer for us. They guided us through Spain's VAT regulations effortlessly, allowing us to focus on scaling our business!

Isabella TanCEO

Isabella TanCEO The streamlined VAT filing process made everything so much easier. Their support is top-notch, and I can’t recommend them enough for anyone looking to enter the Spanish market.

Carlos RiveraOperations Manager

Carlos RiveraOperations ManagerTestimonial 3

John SmithCEO

John SmithCEOThe streamlined VAT filing process made everything so much easier. Their support is top-notch, and I can’t recommend them enough for anyone looking to enter the Spanish market.

Carlos RiveraOperations Manager

Carlos RiveraOperations ManagerTheir expertise in local laws and competitive pricing were key to our success in Spain. We felt supported every step of the way! With their help, we felt secure and got things done quickly in the market.

Tania EcheverríaFinancial Director

Tania EcheverríaFinancial DirectorFiling your VAT return in Spain can be a complex process, but you don't have to do it alone.

Whether you're a local business or an international entity operating in Spain, having the right support is essential for compliance and peace of mind.

Our experienced team is ready to assist you every step of the way. You can provide us with your existing ledgers and VAT analysis, or we can create comprehensive records tailored to your specific needs.

Don’t let VAT filing stress you out—submit your VAT return in Spain with confidence today! Reach out now to get started!

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

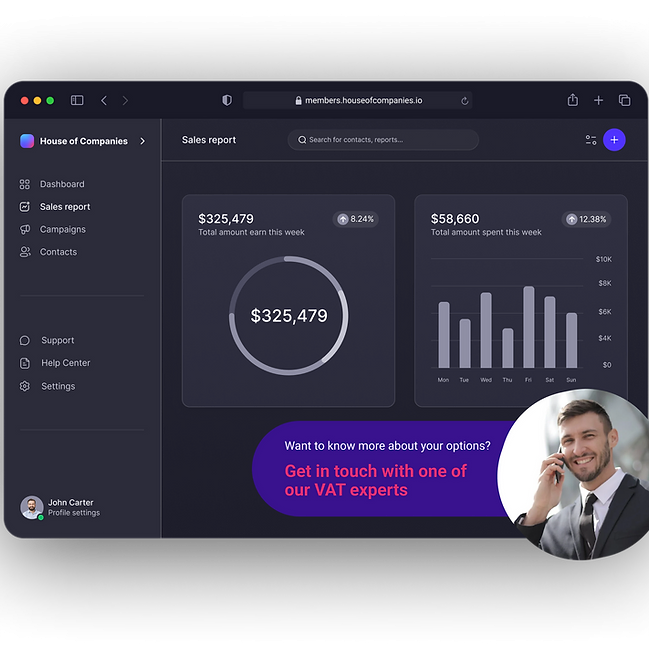

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!